Passive Income Calculator

HOW TO USE THIS CALCULATOR

Step – 1

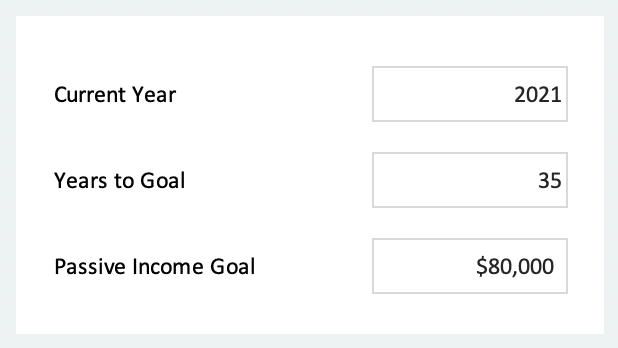

Once you download the spreadsheet start off by inputting the current year, how many years until you want to reach your income goal from real estate investing, and what your passive income goal is. Passive Income simply means money that you don’t have to work for. Investing in Property will provide you with rental income, and the end goal is to use that rental income to partially or completely replace the income that you work for every day. A common goal is $100k passive income. This spreadsheet will calculate the passive income from property to see what you need to do to get to your goal

Step – 2

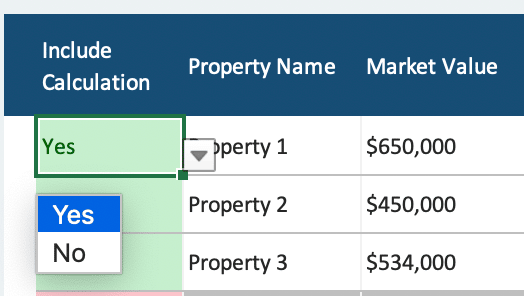

The next step is to input each property. You can include the investment property into the calculation by selecting “yes” under the dropdown.

Step – 3

The next step is to enter the details of each real estate investment.

The Market Value is the value of the property at Acquisition Year. Or if the acquisition year is before the current year, then Market Value is the value of the property at the current year.

Acquisition Year is the year the property is to be purchased.

Growth Rate is the yearly percentage change in the value of the property.

Rent per week is the weekly rental income. Rental Growth is the yearly percentage change in the value of rental income per week. Weeks Vacant is the number of weeks projected that the investment property will be vacant. This is to account for changes of tenants and vacancies in the calculation.

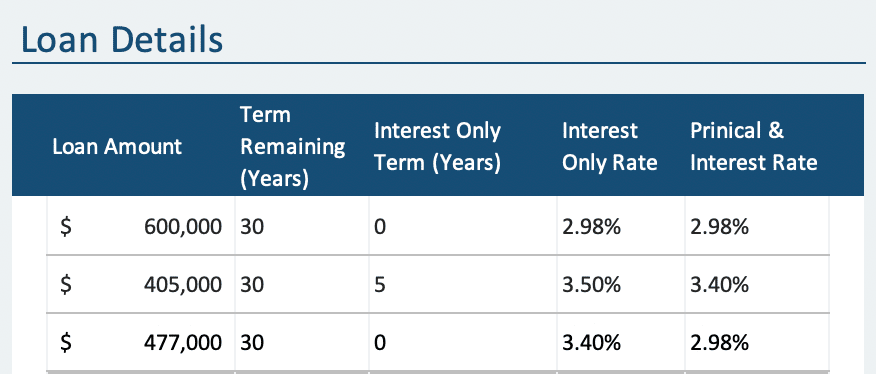

The next step is to fill out the loan details. The Loan amount is the total loan owing at the acquisition date. If the acquisition year is before the current year, the loan amount is the total loan amount owing in the current year.

There is the ability to input an interest-only term for the life of the loan.

Step – 4

The final step is to input the yearly expenses and the percentage increase per year for the expenses.

Once you have finalized all the inputs you will see this Property Investment Calculator has a number of handy outputs.

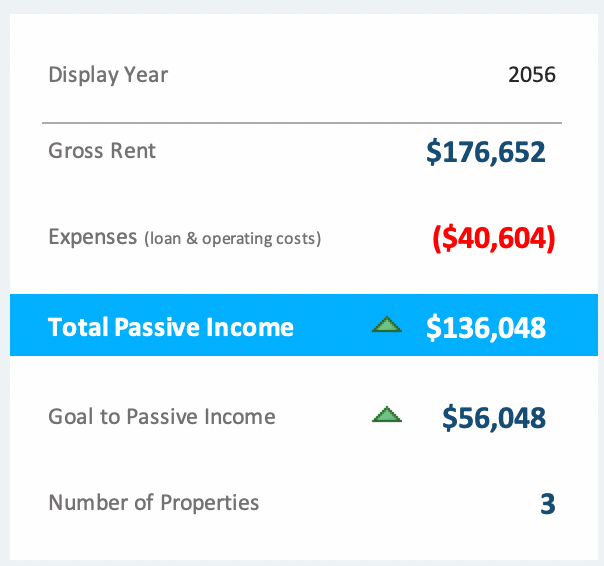

You will see the Display Year. This is calculated as Current Year + Years to Goal. For example, if the Current Year = 2021 and your goal is 20 years, the display year will be 2041.

Gross rent is the total rental income calculated from all investment properties before loan repayments, expenses, and tax. This calculation is at display year.

Expenses are the calculation of all expenses including loan repayments during the Display Year.

Total Passive Income is Gross Rent minus Expenses at Display Year. This does not factor in tax.

Using this property investing calculator is a great way to plan ahead and get an idea of how many properties are needed to earn the level of income you want to earn. If you are looking to download this calculator, fill out your details below and we will send it to the email you use.

ACCESS BY FILLING THE FORM BELOW

Copyright © 2001-2026 Positive Real Estate Pty Ltd.

Registered Office: Unit 20, 2 Pippabilly Place - Upper Coomera, QLD, 4209

ACL 4477275 | Corporate Licence 1217226

The information on this site, including statements, opinions and documents available on this site is for general information purposes only. It does not contain financial advice, and does not take into account your objectives, circumstances, or needs. Members and representatives of the Positive Real Estate are not licensed to give advice in relation to financial products, including Self-managed Superannuation Funds. You should obtain your own financial, taxation and legal advice before making any investment decision.