2 Key Tips To Profitable Property Investing You Might Be Missing

Getting started as a property investor can be quite daunting. This is due in part to fear of the unknown. There is no lack of information available to beginning property investors, but not all information is created equal. In other words, some of it is completely wrong.

Take for example the way that people buy real estate. The common pattern that new property investors usually follow begins with a story. The story then becomes a strategy. For example, the story might be that interest rates are going up so I’m not going to buy real estate.

Another conventional story is that you should buy on affordability. If, for example, you go to a broker and he says you can borrow a half million dollars, well then that’s your story.

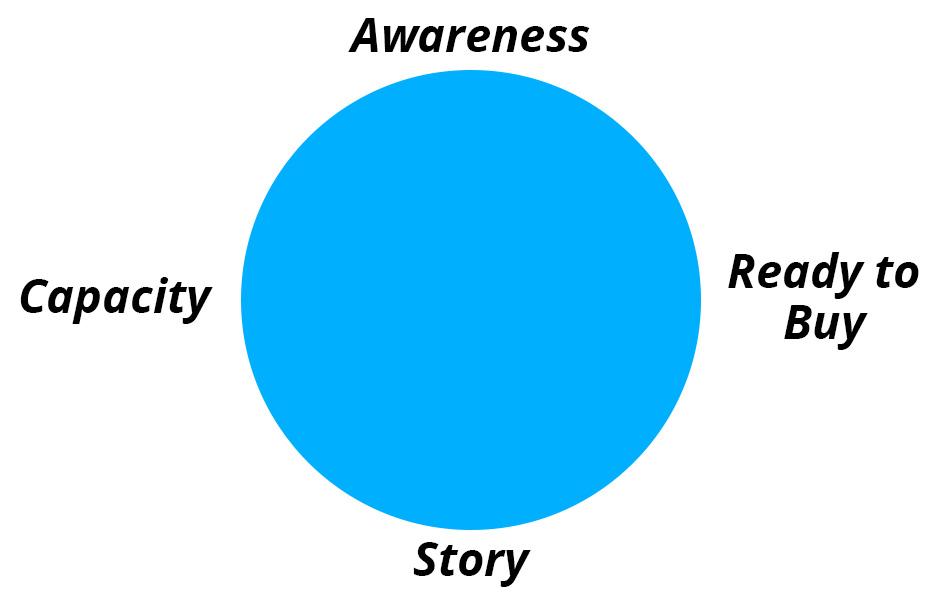

Take a look at the chart below. When you’re only focused on the story, you’re missing 2 key steps when it comes to understanding what to do in the real estate market: Capacity and awareness.

A new investor will often jump from his story straight into “ready to buy” and miss the other 2 key elements entirely. For example, after getting his finance approved an inexperienced investor might think that all he needs to do is find something that he can afford and buy it. But what if the property he can afford isn’t the best possible property right now and won’t make him any money?

Obviously he would need to rethink his strategy. Getting involved in real estate is about making money – it’s about making a profit, not attaching yourself emotionally to a piece of real estate.

So what should you do instead? Consider the other two elements that go into buying real estate.

Capacity

Capacity consists of things like time. How much time do you have to research real estate? How many offers are you putting out on real estate at the moment to get yourself the best deal? Time is a huge benefit. If you spent all day, every day in the real estate market do you think you’re going to get a better deal? Of course you are, that’s just the way it works. It’s a ratio. The more you do something the better you get at it.

Educationis also an element of capacity. At our Property Investor Nights you’ll hear a lot of this stuff about how to get the right ratio to buy the best piece of real estate you possibly can.

Once a new investor has been approved, he may go out over the weekend, with half a million bucks in his pocket courtesy of the finance broker or the bank, spend 5 or 10 minutes looking over a piece of real estate and end up buying it. It’s a story in his head.

The better story would be to work out how you’re best going to utilise your time to make some money. For example, why not take the time that you would have spent shopping for a home that may or may not be profitable, and spend it educating yourself about property investing?

At our Property Investor Nights, we’ll show you a good plan to make some money in the real estate market. It’s not uncommon for individuals to be uneducated in how to make money with real estate – after all, it’s not a typical course of study at school. There are some great strategies which we can show you that will put you well on your way to making a good little profit out in the marketplace.

Another element of capacity is having a team.

If you’re surrounded by the right team you’ll be amazed at the success you can achieve. Often, a beginning investor will simply find himself a broker and a lawyer and call it good. Then he’ll wander around the market, thinking he knows what he’s buying, but in reality, it’s just the story in his head.

Often, when he finds something that appeals to him, he’ll buy it because he can afford it, not because it is necessarily a good deal, or a property that will make him money.

Awareness

A big reason to come to one of our Property Investor Nights is understanding awareness. For example, what markets are the best markets to buy in right now?

If I could show you a marketplace which is going to double over the next 3 years – where you’ll double your money – would you be more likely to buy in that market or would you simply follow the story in your head that you should buy in your local suburb?

There are some great markets in Australia, and if you’re aware of them you can make some money. When you come along to one of our Property Investor Nights, we’ll show you our property cycle clock – a tool we use that reflects where the particular markets around Australia are right now – and we’ll show you how you can use this strategy to achieve the best profits possible.

What about awareness of finance? A common mistake a new investor might make is cross securitising his loans. Once he’s done this, his finances can become tied up – keeping him from moving forward in his investing.

Sure, he may get the cheapest interest rate, but what is he giving up in return?

At our events we’ll discuss some fundamentals on how to structure your loans so that your properties stand alone rather than interconnect. This is a very important element of property investing – especially if you want to move forward in real estate.

Before jumping right into property investing, it’s important to consider that capacity and awareness need to be addressed before moving forward to purchasing. It’s easy to have a story in your head that you should buy real estate, and to be candid, it’s pretty simple to go out and be ready to buy real estate.

Understanding capacity and awareness is the trademark of a brilliant property investor. An individual who has made solid wealth understands the importance that awareness of the market has on his story, and has the capacity to get things done.

For more information about key strategies you might have missed, come along to one of our complimentary Property Investor Nights. They’re held all over the country, so chances are good there’s one near you!

Click here to like us on Facebook and see more updates like this.

Hey there, do you enjoy the Positive Real Estate Blog? If you did, why don’t you book into a Property Information Night in your area and get more information from our team. You can do so here.

Also, if you can not wait, click here to access the Property Mini Course and signup for our email newsletter. This FREE 2 hours video series gives you some of the top tips from our team that you can use right now. Thanks.

Take the Next Step

Building a $100k Passive Income Stream Through Property: The ‘Property Stacking’ Method Explained

Discover how to build a $100K passive income stream through property using the proven Property Stacking Method. Learn the three core principles smart Australian investors are using to scale their portfolios faster — without financial stress.

Investment Property Financing – Comprehensive Guide 2023

You won’t get very far as an investor without...

Ultimate Property Investment Strategy Guide 2023

Which Property Investment Strategies Will Make...