Are You at Risk of Losing Millions?

Shocking Factors That Could Affect Your Investment Wealth

Predicting what could affect our investment wealth, and where the smart buying opportunities exist, is getting more complicated.

A 2020 news article suggested that Australian home owners could face millions of dollars in losses if their homes are affected by sea damage or coastal erosion due to the fact that most major insurance companies will not insure properties against environmental damage.

Considering that all major Australian cities are coastal, and most of the richest neighbourhoods are beachside, the growing threat of severe weather incidents due to global warming throws a serious spanner in the works when considering where to buy and invest.

If you’re a climate change sceptic, we’re not here to judge. But that position isn’t going to help you if the institutions you rely on to protect your assets won’t have a bar of your $3 million beachfront house.

While you can’t single-handedly stop climate change, you can gain a greater understanding of the other factors at play in what can affect your property investment wealth in both positive and negative ways.

INDUSTRY

Areas that are rich in industry is one good indicator that capital growth will happen. This is especially important to investigate if you’re looking at regional towns. While you may get more for your money than in a major city, will the area continue to thrive and survive? Does it have more than one industry that will attract jobs and people? While some regional towns are more like ghost towns now, others, such as Mudgee in NSW, are thriving. The tourism, mining, agriculture and wine industries that exist there are sustaining the region and allowing it to grow. Do your due diligence and make sure you know the region you’re buying into has a future.

INFRASTRUCTURE

Infrastructure investment and development is another key influence in property investment wealth. If billions of dollars are being poured into local schools, transport and hospitals, the region will be supported by employment opportunities. The more people who come to work, the more homes will be in demand, and so the rent rates rise.

LIVE, WORK, PLAY

One of the effects of COVID-19 has been an acceleration in the pre-existing shift of more people wanting to live, work and play within a 20-minute radius. Suburbs adjacent to CBD’s, with easy access to exciting social activities and green space, offer the renter or buyer much more than just a dwelling.

The Third Space – the area close to your home that gives you a lifestyle you crave – is a significant factor on what will continue to grow investment wealth. Check out the walk score of a neighbourhood, investigate the health and well-being benefits of the community and find out if people are starting to see the area as a “place economy”. If people want to be seen and live there, property prices and rent rates will rise.

INSTITUTIONAL DUE DILLIGENCE

Lastly and most importantly, make sure you fully understand your level of coverage and vulnerability risk.

The institutions that support us as property investors by underwriting and protecting our assets are a vital part of our ongoing success and wealth creation. We need them on our side.

Minimise your risks by doing your due diligence and making sure you can get the right protection for a property before you purchase it.

SAFETY FIRST

Setting your property portfolio up for success from the get-go is a crucial factor of safe investing. With so much money on the line you need to ensure you have the knowledge and a strong strategy in place that supports your long term financial goals.

To learn more about how you can do this, join our free property investing seminar and make sure you have the key fundamentals in place to achieve prosperity and wealth. Afterall, no one becomes an investor to stay stagnant or lose money.

Limited spots are available. Book here now.

Recent Articles

10 Property Investment Tax Mistakes To Avoid

Tax isn’t often one of those conversations that give investors the warm fuzzies, especially when we’re talking about the 10 property investment tax mistakes to avoid! But it’s important that property investors reframe their thoughts around tax. Owning real estate can actually be incredibly tax effective – in fact some might say tax is a secret weapon for property investing.

How Lenders Assess Valuation Risk Factors When Financing

Ever thought you’d picked an absolute winner of a property only for the bank to come back with a list of valuation risk factors? It’s more common than you think, particularly in a rising market where values fluctuate so much that our ideas of what a property is worth actually start to disconnect from what a valuer sees.

Tips For Buying An Investment Property

Have you decided to take the property investment journey but are feeling clueless as to how to actually board the train? We’re going to give you our top five tips for buying an investment property in 2022 to help point you in the right direction!

Is Property Investment a Good Investment Asset for You?

Why is property investment a good investment? Why not invest in shares or bonds instead? Which investment is the most secure? If you’ve come to a crossroads in your life where you’re ready to start building your wealth but questions like these are bouncing around your head, then it’s time to sit down and start your education on investing.

Buying an Investment Property Before a First Home in Australia?

Owning property has always been part of the great Australian dream. A lot of people want a place to call their own, with stone benchtops, the latest appliances and a great entertaining deck out back. So, when interest rates hit a record low in the last couple of years and it suddenly started to cost the same to own as it does to rent, why wouldn’t you have just bit the bullet and bought your own home?

The Ins and Outs of Real Estate Risk Management

If you’re new to property investing, what is your risk profile and how do you plan to handle it? Real estate risk management is essential to quashing those all-encompassing fears that can follow investing…

Positive Cash Flow Property – Ultimate Guide 2023

If you want to become a superstar property investor and be on the path to financial freedom, then you’re going to need this guide to investing in positive cash flow properties! Investors that follow a positive cash flow strategy understand that living off passive income is the key to an early retirement – and the only way to do that is to make our money work for us, not against us.

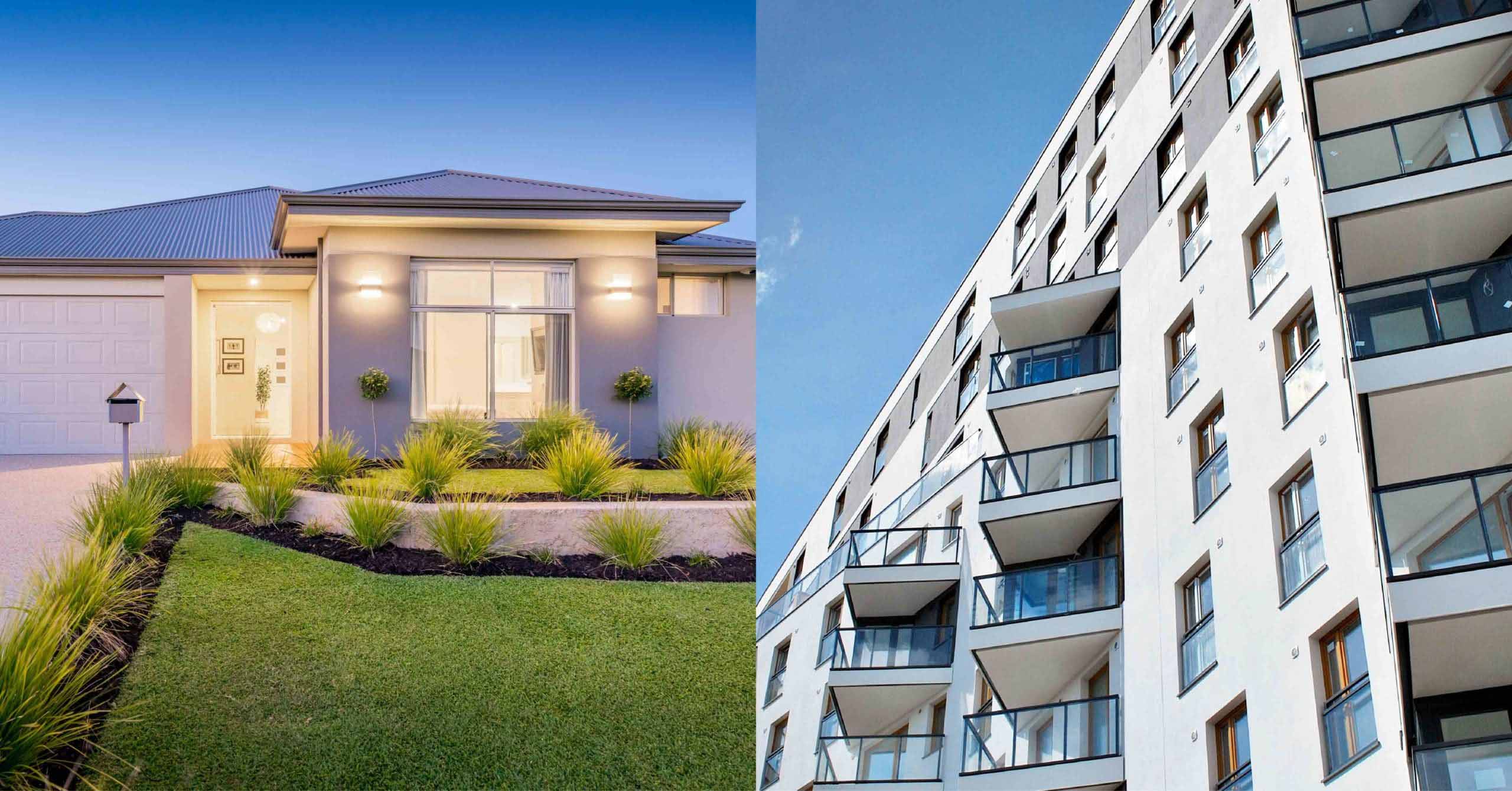

House Vs Apartment Investment – Which Is Better?

These days property comes in all shapes and sizes, giving property investors more options than ever before. The question on everyone’s lips when it comes to the house vs apartment investment equation, is how do you truly know which is better?

The All Monies Mortgage Clause – What You Need To Know!

This article is about the all monies mortgage clause and how it can potentially affect your property investment. When you signed your bank loan agreement to secure funds for a mortgage, did your contract contain an all monies mortgage clause?