Opportunity Cost

By now I’m hoping you have had your “What Can I Do Now” appointment, or at least booked it in.

Have you written your goals? Have you devised a long term strategy? Do you know what you are looking for in your next investment?

If yes, fantastic!

If the answer is no, because you are not quite there yet, then grab this Goal Setting guide, a tea, coffee or wine, find a quiet spot and go through it. Make time for yourself and your dreams.

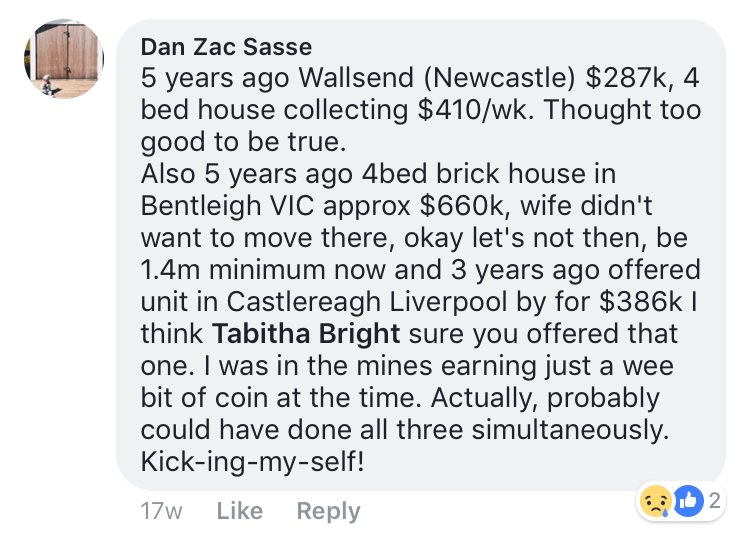

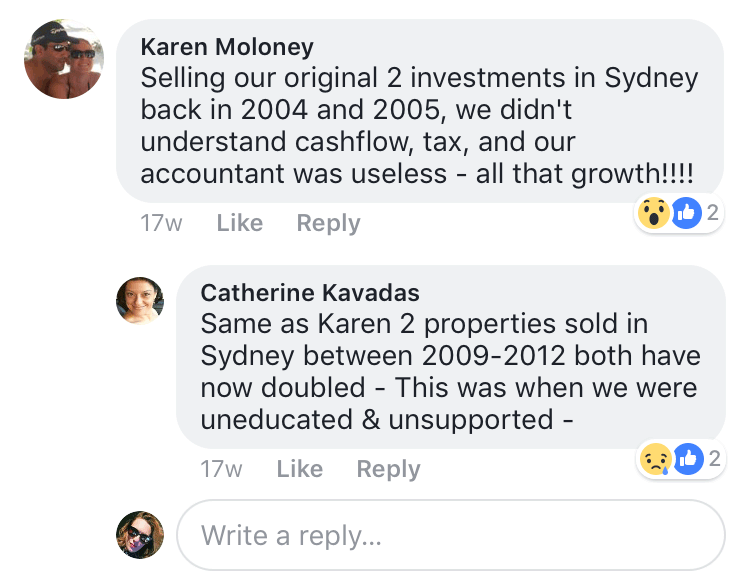

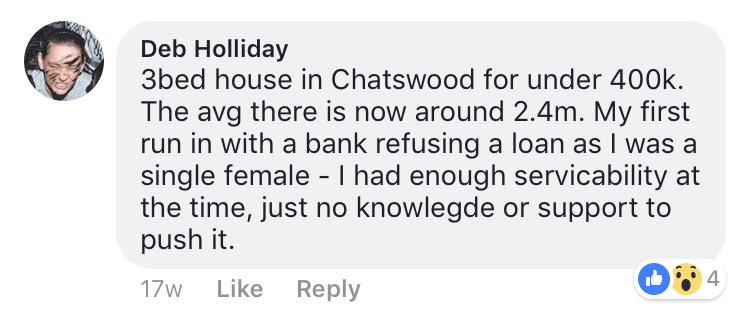

Nothing is more expensive than lost opportunity.

All the “what if’s”…It’s heartbreaking and frustrating, as Malcolm has pointed out…old wounds.

It is important to not always go for the quick wins and to stick to your strategy. That is what a property coach is for, to keep you on target.

Imagine if you don’t come and meet with our team and even see what is possible? Even if it is just to have us to tell you you’re doing an awesome job and are on the right track!

The Lifetime Mentoring Program is a great way to make sure you stay focused on your goals and dreams and ensure that all your purchases work together to achieve your investment strategies. A Positive Real Estate Coach and their team is like having a Personal Trainer for your portfolio.

Successful Property Investors Don’t Quit Their Day Job

You need that income! One of the primary things you need to be a successful property investor is a job. Why? Because you need money. You need a job to borrow money. You need savings or some cash to buy your first property. But the sad fact is, a lot of people...

6 Ways To Speed-Up Your Next Property Purchase

Get There Faster If you are already a property investor with one or even two properties, first of all, congratulations. You’ve taken some seriously great steps in creating your future wealth and a pathway to a work-less, play-more retirement with passive...

Property investing: Five ways to create cashflow boom!

When it comes to property investment there are some things you can never have enough of.

When it comes to property investment there are some things you can never have enough of. Good tenants, reliable builders, a great relationship with your bank.

But more than anything what you need is good cash flow.

Having a steady income of cash means never having to dip into your own pocket to top up repayments, complete repairs or make another purchase.

Here are the top five ways you can ensure the cash keeps flowing, so you can keep your investment portfolio growing.

Lock it in! How to protect your equity

Don’t be caught without it.

As a property investor who is building a portfolio, it’s vital that you have access to your equity whenever you need it.

There’s nothing more frustrating than finding that perfect new property to purchase, only for it to be held up – or worse still, lost completely – because your finances weren’t in good shape.

Having an interest-only loan structure with a healthy off-set account is a great way to ensure you have equity at your fingertips whenever you need it, but that’s not the only way…