Property Cash Flow Basics For Creating Passive Income

Buying real estate is similar to running a business – good performance is derived from your ability to generate cash flow.

For a property investor, this means eventually living off the passive income that your real estate generates. Therefore, it is especially important that you map out your ability to build a portfolio that will deliberately achieve this level of success from the get-go. Because let’s be honest, we’re not going to be able to rely on a pension in later years to give us the basic security we want or need.

The good news is, we don’t have to take huge risks to get a sensible return; after all, you can get home loans well below three per cent and easily find a six per cent return. What this means is your real estate ownership is completely covered by the tenant’s rent without you having to dip into your own pockets.

CASH FLOW BASICS

Let us start with some cash flow basics.

There are three parts to the cash flow riddle: your wage, the taxman, and your tenant. If your tenant can pay the rent and it covers your mortgage, you are doing well.

Your own cash flow is freed up, so you are not constantly forking out to hold your property. The longer you own real estate the more likely this is to occur.

Having a combination strategy that includes both cash flow and capital growth will provide you with serviceability and equity as a borrower, and will allow you to continue to move forward, so focusing only on yield is a flawed approach.

Equity and servicing allow you to buy more properties, borrow more money and keep building your wealth.

POSITIVE AND NEGATIVE

Often investors hear the terms ‘positively geared’ or ‘positive cash flow’ but are not sure exactly what they mean.

The easiest way to understand these terms is that positively geared properties occur when the rental return and tax breaks cover your loan repayments and outgoings, leaving your wage or income unaffected.

Positive cash flow properties are self-funding, and you do not need your tax deductions or your wage as the rent pays for everything.

Conversely, negatively geared properties occur when the rental return and tax deductions are less than your loan repayments and outgoings, placing you in an income loss position on the property.

There is, however, the underlying expectation that the accumulated losses will be more than offset by the capital growth on the property. In this circumstance, the rental return is not considered as important in the decision process, and you should also have a wage that you are happy to access to help cover the mortgage.

Many people today find the right negatively geared property and ownership may only cost $50 per week.

The key benefit associated with negative gearing is that the loss attributed with ownership of the property can be offset against other income earned, reducing your assessable tax income, thereby reducing your tax payable.

The result is that the cost of owning the property is being funded by your tenant (in the form of rent), the Tax Office (in the form of tax savings) and your surplus cash flow.

Ultimately, most investors will aim to be positively geared in the long run. As your rents increase and debt on your property drops, you can even begin to replace your wage with rental income.

FIND THE BEST RENTS

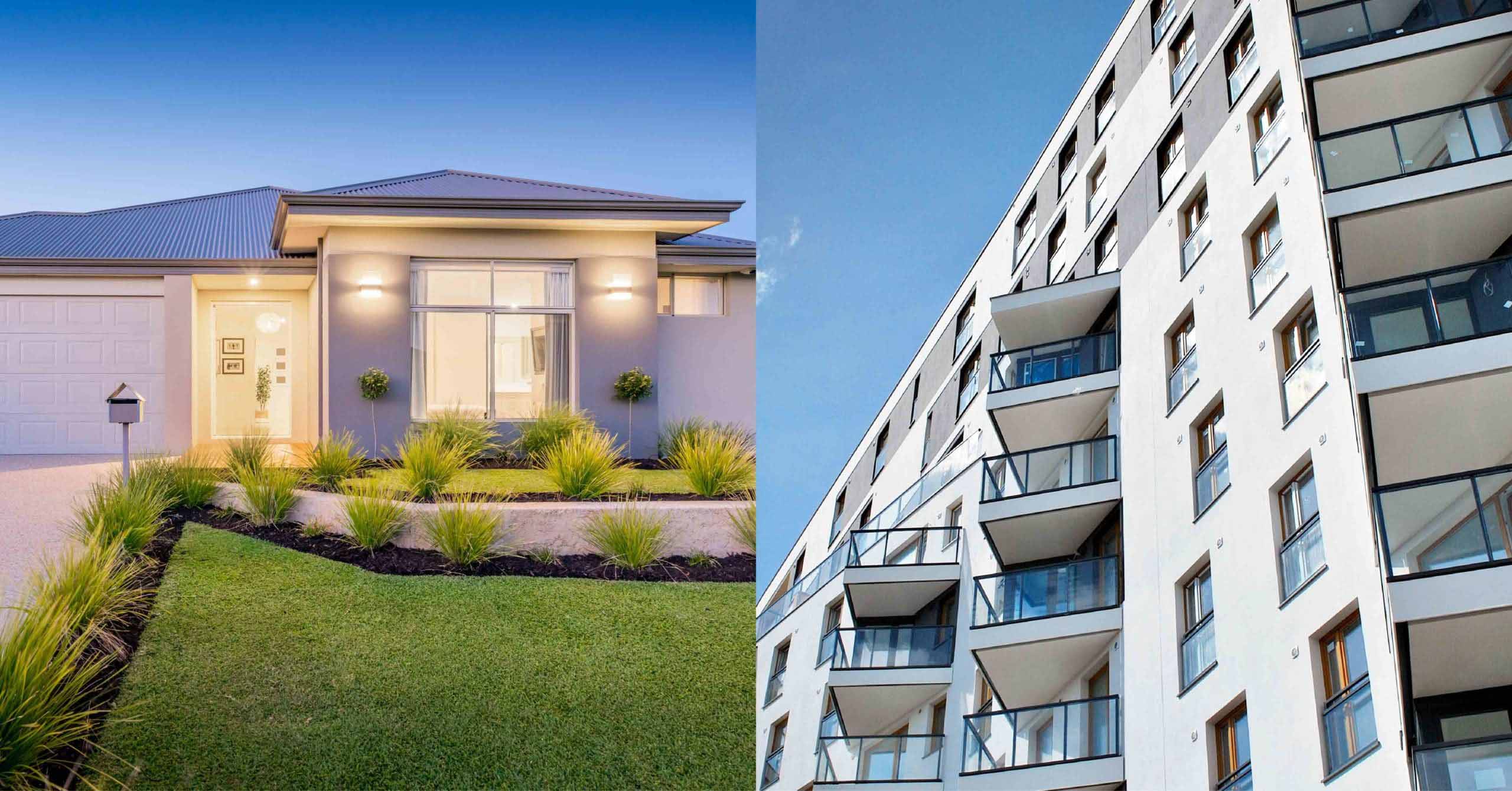

I recently had two clients buy a property on the same street. My first client paid about $600,000 and bought a high-pedigree piece of real estate and received $700 per week in rent, which is a pleasing return.

My other client decided to pay less and bought an inferior property with inferior inclusions for $550,000, believing they were getting better value given the $50,000 price difference but not realising the fixtures, fittings and design matters in real estate to renters.

My second client is now only getting $450 per week. The difference in rent is huge. Yes, they were comparable properties in terms of price range, but one was superior and true value for money, while the other fell into the cheap category and is now in a race to the bottom.

The superior rent allows that client to pay off debt faster and fast track their wealth creation.

ESTABLISH YOUR CASH FLOW PLAN TODAY

Moral of the story? Cash-flow is king when it comes to being a successful property investor. Learn how to build a strong and profitable property portfolio by mapping out a clear cash-flow pathway at our free property investing seminar.

Our expert coaches will explain all the components required to create a strategic and robust property plan so you can move forward fast.

Register now for the free property investor webinar

By Sam Saggers

Recent Articles

10 Property Investment Tax Mistakes To Avoid

Tax isn’t often one of those conversations that give investors the warm fuzzies, especially when we’re talking about the 10 property investment tax mistakes to avoid! But it’s important that property investors reframe their thoughts around tax. Owning real estate can actually be incredibly tax effective – in fact some might say tax is a secret weapon for property investing.

How Lenders Assess Valuation Risk Factors When Financing

Ever thought you’d picked an absolute winner of a property only for the bank to come back with a list of valuation risk factors? It’s more common than you think, particularly in a rising market where values fluctuate so much that our ideas of what a property is worth actually start to disconnect from what a valuer sees.

Tips For Buying An Investment Property

Have you decided to take the property investment journey but are feeling clueless as to how to actually board the train? We’re going to give you our top five tips for buying an investment property in 2022 to help point you in the right direction!

Is Property Investment a Good Investment Asset for You?

Why is property investment a good investment? Why not invest in shares or bonds instead? Which investment is the most secure? If you’ve come to a crossroads in your life where you’re ready to start building your wealth but questions like these are bouncing around your head, then it’s time to sit down and start your education on investing.

Buying an Investment Property Before a First Home in Australia?

Owning property has always been part of the great Australian dream. A lot of people want a place to call their own, with stone benchtops, the latest appliances and a great entertaining deck out back. So, when interest rates hit a record low in the last couple of years and it suddenly started to cost the same to own as it does to rent, why wouldn’t you have just bit the bullet and bought your own home?

The Ins and Outs of Real Estate Risk Management

If you’re new to property investing, what is your risk profile and how do you plan to handle it? Real estate risk management is essential to quashing those all-encompassing fears that can follow investing…

Positive Cash Flow Property – Ultimate Guide 2023

If you want to become a superstar property investor and be on the path to financial freedom, then you’re going to need this guide to investing in positive cash flow properties! Investors that follow a positive cash flow strategy understand that living off passive income is the key to an early retirement – and the only way to do that is to make our money work for us, not against us.

House Vs Apartment Investment – Which Is Better?

These days property comes in all shapes and sizes, giving property investors more options than ever before. The question on everyone’s lips when it comes to the house vs apartment investment equation, is how do you truly know which is better?

The All Monies Mortgage Clause – What You Need To Know!

This article is about the all monies mortgage clause and how it can potentially affect your property investment. When you signed your bank loan agreement to secure funds for a mortgage, did your contract contain an all monies mortgage clause?