Squeezed For Cash? 5 Quick Ways To Increase Your Cash Flow

Is your property portfolio putting your cash flow in a vice? If you’re squeezed for cash because of your investments – and if you’re investing in property, that’s the worst place to be – its probably because you have a negatively geared portfolio.

Sound accurate?

Don’t worry – you aren’t alone. According to the Australian Bureau of Statistics, in 2005, over two-thirds of investors had negatively geared properties. Ouch! That’s 67% of investors losing money from property.

In 2011, negatively geared properties cost $13.2 billion. $13.2 billion. Imagine what you could do with $13.2 billion…

Of course, you can claim negative gearing on tax, and try to save some of your money from the government – but you have to be on a huge salary to benefit from that! The average Aussie can’t afford negative gearing.

Don’t worry – we’ve got 5 Cash Flow Solutions right here to help free you from financial struggle – and that nasty negative portfolio!

1. Debt Management

Debt – especially uncontrolled debt – is one of the most damaging things you can do to your cash flow.

Wipe out your debt – especially your bad debt – and you immediately improve your cash flow and expand your lifestyle choices.

Get started now:

- If you haven’t already, speak with a professional property finance expert to be sure that your portfolio is working as hard for you as it can.

- Create a workable budget that you can live with. Don’t be too rigid but also challenge yourself to see how much you can save and conversely how little you can spend. Make a game of it and you just might surprise yourself.

- Ring up your bank(s) and negotiate interest rate cuts on your credit cards. If the costs are not excessive try to get the interest on your investment and home loans slashed too.

- Release any equity you may have and then use the cash directly to reduce your debts or use it to buy positive cash flow property, depending upon where you’re at financially and what your goals are.

- Take a close look at your offset account(s). Have you been dipping into it when you shouldn’t? Remember that it’s for your future and dip into the capital only for investment needs.

- Put all of your income into a single, interest bearing account and live off your credit card, provided it has at least a 45-day grace period. Then, pay it off in its entirety each and every month to avoid paying any interest.

2. Positive Gearing Using Your Tax Deductions

Book an appointment – if you haven’t already – with an accountant who is experienced in the tax laws surrounding property investment.

If you’re a PAYG earner, claim your tax deductions on a continual basis; either weekly, fortnightly or monthly, and put those monies straight into your offset account where compounding interest can work its magic.

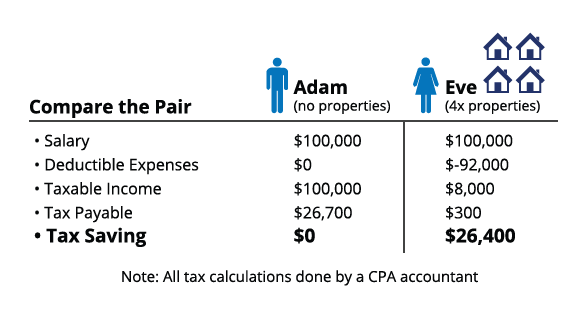

Then, depending upon your personal situation, add more investment properties to increase your wealth. Take a look at the following example:

As you can see, investment properties can significantly reduce your tax liability, shrinking the amount of tax that the ATO can collect!

3. Buy Positive Cash Flow Properties

Begin by looking for areas with strong market drivers:

- Infrastructure spending

- Economics

- Supply (low) and demand (high)

- Demographics

- Rental Yield (5%+)

- Population Growth

Using one or more strategies; renovation, second income stream, subdivision, strata and/or a straight-up discount purchase you can put together great positive cash flow deals right out of the gate!

The key is knowing what to look for:

- In areas where units are in demand find a property that needs just a bit of surface renovations. Be sure to include renovation costs when making your offer.

- A duplex or small block of units can be strata titled, which can really boost your equity in a fairly short amount of time. This is because you’re forcing value, rather than waiting for the market to do it for you.

- Homes typically appeal to families, so if the area demographic goes after houses find properties that can support a subdivision or renovations – perhaps even both – for a positive return.

Don’t be afraid to invest in other states. Not only will you speed up the rate at which your portfolio will grow (because you’re not having to wait on the market cycle), you’re greatly expanding your choice of good investment opportunities.

Quickly determine the potential GROSS yield of a property by doing the following:

- Weekly rent x Weeks in the year = Annual rent divided by purchase price x 100

- $320pw x 52 = $16,640 / $200,000 = 0.0832 x 100 = 8.32% gross yield

To calculate the net yield you’ll follow the same formula, however you’ll deduct the actual expenses of the property (not including the interest you pay) before dividing the rent by the purchase price:

- Annual rent – property expenses divided by purchase price x 100 = net yield

4. Trade Real Estate

Getting a good deal when trading real estate begins when you purchase the property. The idea is to of purchasing the property. Here’s how:

- Buy at a discount

- Hold onto the property and add use an add value strategy to force equity

- Sell when the market is at it’s hottest

5. Use Equity Growth As Cash Flow

Find markets where the capital growth is consistently strong and then use the equity the market delivers to fund more deals and to cash flow your lifestyle.

Shoot for equity of $30,000 to $50,000, which can be used to service your properties, add to your portfolio and fund your lifestyle.

It’s certainly possible to find properties where the equity is already built into the property. In a fast growing marketplace you can tap into that equity in about 12 months time and add to your account where compound interest can get to work growing it even more.

Click here to like us on Facebook and see more updates like this.

Hey there, do you enjoy the Positive Real Estate Blog? If you did, why don’t you book into a Property Information Night in your area and get more information from our team. You can do so here.

Also, if you can not wait, click here to access the Property Mini Course and signup for our email newsletter. This FREE 2 hours video series gives you some of the top tips from our team that you can use right now. Thanks.

Take the Next Step

Investment Property Financing – Comprehensive Guide 2023

You won’t get very far as an investor without...

Ultimate Property Investment Strategy Guide 2023

Which Property Investment Strategies Will Make...

How to Build a Property Portfolio with $100k or Less

Starting your property investment journey can...