The Only Time You Should Sell An Investment Property

The golden rule of property investing is to buy well and NEVER SELL. However, there are always exceptions to the rule…

Firstly, let’s look at why you would keep an investment property? If you buy a great piece of real estate, in the right location, it will always create a passive income for you, so there will be no reason to sell it.

Also, selling property is EXPENSIVE! It costs you money in styling, agents fees, possibly a loss of rental income during the process, and taxes.

In a perfect world you would never need or want to sell an investment property.

But… as we all know, we don’t live in a perfect world and sometimes, even with the best of intentions, things don’t always go the way we expect.

So, are there times you should sell a property? And how do you know when it’s time to sell?

One major reason people go down this road is because they bought bad in the first place. Often times when we’re holding onto bad stock that’s weighing our portfolio down, the best option is to sell.

We’ll break down what a dud looks like in a moment, but first lets’ tackle the big question – how did you end up buying a bad property?

LACK OF STRATEGY

Too many people who have got the means and desire to become a property investor jump in with zero strategy.

They listen to the wrong people about what, when and where to buy and make decisions that aren’t based on expert information or knowledge.

While some might get lucky and do alright, others end up with a lemon.

The real reason behind this is a lack of strategy.

Property investment is a marathon, not a sprint, and to play a long game you need a well prepared, thought out strategy.

An investment plan will ensure you ask and answer questions like these and so many more:

- How much income do I need to live the life I want?

- How many properties will I need to make that income?

- How long will it take me to buy those properties?

- Do I have the means to create financial buffers for myself and each of my investment properties should things change?

- Do I know what kind of loan structure I need?

Without a strategy you’re in the dark, which is never a good place to be when it comes to smart investment choices.

WHAT IS A DUD PROPERTY?

In property investment a dud property is one that is holding you back. This one property is stopping you from achieving your goals of creating a portfolio that will create enough passive income for you to live your best life.

How does a property hold you back?

- It’s in negative cash flow

- It’s too old

Negative cash flow is the last thing we want as property investors. Cash flow is king and without it we can’t buy our second, third or fourth property.

Even if the property is growing in capital value, if the cash flowing out of your pockets is negatively impacting the servicing of your loan, you won’t be able to borrow enough to raise your next deposit. You also won’t be able to access any equity you’re making.

Equally, an older property that is costing you so much in maintenance costs and repairs that it’s sucking the life and cash out of you, is a dud. If you get to the stage where it’s going to cost you less to demolish and rebuild, than it will to fix up the current structure, you have a decision to make.

WHEN IS THE RIGHT TIME TO SELL

While we know there might be times that selling is the right thing to do, take your time and think about what you’re trying to achieve.

Also, what are you going to do with the cash you get from the sale, where will that money go to serve you best?

Migrating your money from a property that you feel has done its job and has nothing else to offer, into one that has long-term potential might incur some costs, but they’re opportunity costs and might be worth the hit.

Just make sure you consult some experts who can help you create a clear strategy. Coaches like those at Positive Real Estate can help you visualise your long-term goals and how to get there.

DEVELOP YOUR GAME PLAN

Let the experts at Positive Real Estate teach you about the different strategies around buying and where appropriate, selling.

Sign up for one of our information and education events, where you’ll be equipped with the tools, resources and support to thrive, and not fall behind on your path to financial freedom – whatever that may look like for you.

Book your spot now and find out what you need to know about the current market landscape and how you can make it work for the ultimate wealth creation opportunities.

Recent Articles

10 Property Investment Tax Mistakes To Avoid

Tax isn’t often one of those conversations that give investors the warm fuzzies, especially when we’re talking about the 10 property investment tax mistakes to avoid! But it’s important that property investors reframe their thoughts around tax. Owning real estate can actually be incredibly tax effective – in fact some might say tax is a secret weapon for property investing.

How Lenders Assess Valuation Risk Factors When Financing

Ever thought you’d picked an absolute winner of a property only for the bank to come back with a list of valuation risk factors? It’s more common than you think, particularly in a rising market where values fluctuate so much that our ideas of what a property is worth actually start to disconnect from what a valuer sees.

Tips For Buying An Investment Property

Have you decided to take the property investment journey but are feeling clueless as to how to actually board the train? We’re going to give you our top five tips for buying an investment property in 2022 to help point you in the right direction!

Is Property Investment a Good Investment Asset for You?

Why is property investment a good investment? Why not invest in shares or bonds instead? Which investment is the most secure? If you’ve come to a crossroads in your life where you’re ready to start building your wealth but questions like these are bouncing around your head, then it’s time to sit down and start your education on investing.

Buying an Investment Property Before a First Home in Australia?

Owning property has always been part of the great Australian dream. A lot of people want a place to call their own, with stone benchtops, the latest appliances and a great entertaining deck out back. So, when interest rates hit a record low in the last couple of years and it suddenly started to cost the same to own as it does to rent, why wouldn’t you have just bit the bullet and bought your own home?

The Ins and Outs of Real Estate Risk Management

If you’re new to property investing, what is your risk profile and how do you plan to handle it? Real estate risk management is essential to quashing those all-encompassing fears that can follow investing…

Positive Cash Flow Property – Ultimate Guide 2023

If you want to become a superstar property investor and be on the path to financial freedom, then you’re going to need this guide to investing in positive cash flow properties! Investors that follow a positive cash flow strategy understand that living off passive income is the key to an early retirement – and the only way to do that is to make our money work for us, not against us.

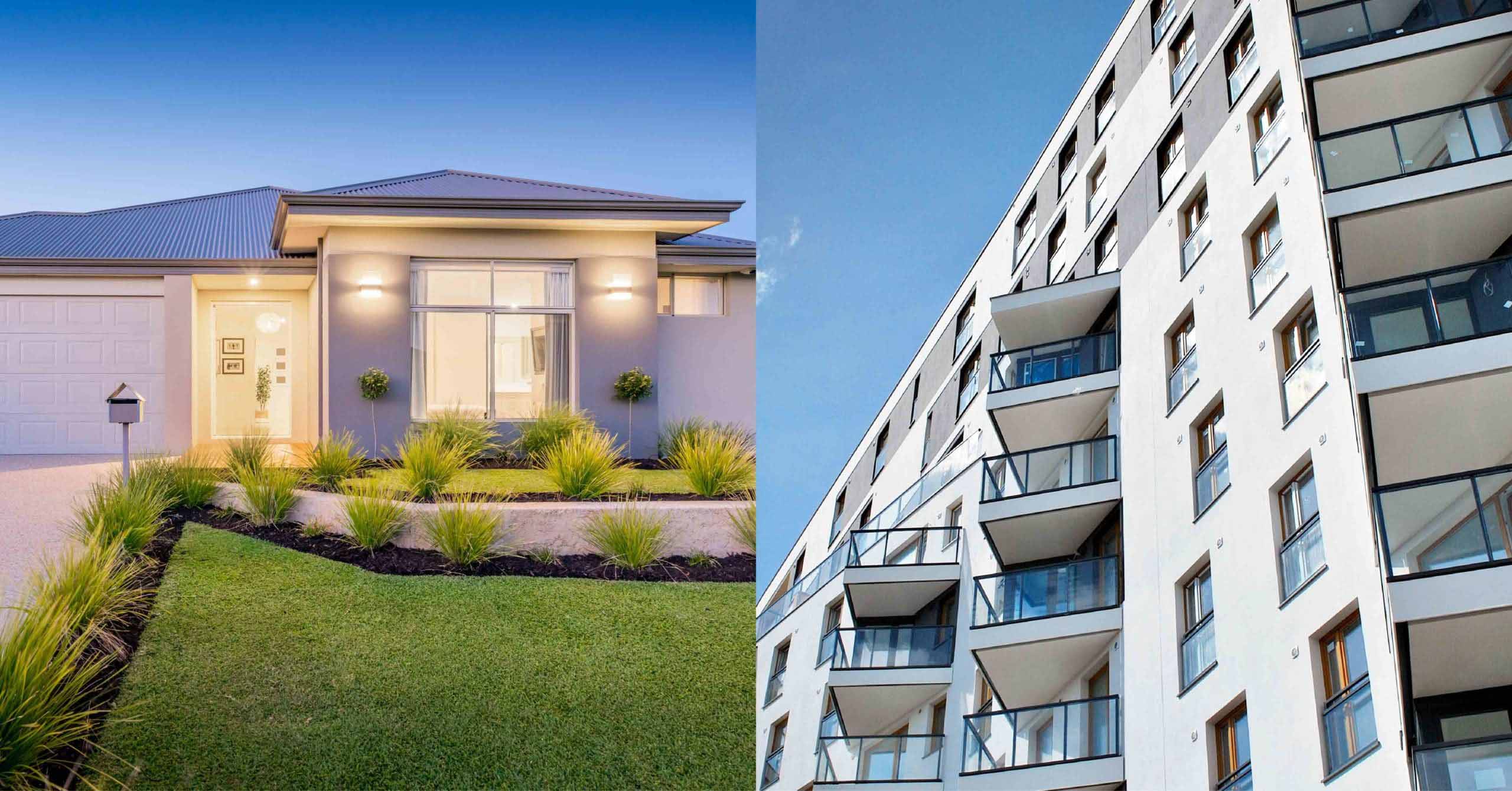

House Vs Apartment Investment – Which Is Better?

These days property comes in all shapes and sizes, giving property investors more options than ever before. The question on everyone’s lips when it comes to the house vs apartment investment equation, is how do you truly know which is better?

The All Monies Mortgage Clause – What You Need To Know!

This article is about the all monies mortgage clause and how it can potentially affect your property investment. When you signed your bank loan agreement to secure funds for a mortgage, did your contract contain an all monies mortgage clause?