Ultimate Property Investment Strategy Guide 2023

Which Property Investment Strategies Will Make You Money?

Building your property investment portfolio involves more than just picking the property type, price, and age.

You must also determine how you plan to make money using that property. There are many property investment strategy methodologies, and we’re going to discuss how each can be used to earn a profit.

What Is an Investment Property?

First, let’s start with the basics. An investment property is any real estate that you purchase with the intent to profit in some way or another. When you buy real estate, you are investing in the property’s short and long-term value.

An experienced investor may own dozens of investments, while others can flourish with one or two properties. Funding property investments is a great way to put huge chunks of your savings to good use so that it doesn’t just sit in the bank.

Property investors purposefully purchase a particular property that meets their portfolio building goals with the intent to renovate and sell, rent and hold long-term. A standard homeowner usually invests in a house to have somewhere to live, which means that the eventual selling profit is just a bonus.

Either way, owning property makes you an investor, so it’s critical to learn how to use your money with the right investment property strategies so you can achieve financial freedom.

Read on to find the

Property Investment Strategy

that Best Works for You!

Handy Info

- 2023 Residential Property Market Trends

- What Different Types of Investment Properties Should You Consider?

- Apartments vs. Houses

- New vs. Old

- Low vs. High Price

- Dealing With Rental Property Managers

- Property Investment Pros & Cons

- How Can You Reduce Property Investment Risks?

- How to Create Your Property Portfolio Strategy?

1. Buy and Hold

Buy and Hold is a tried and true property investment strategy. It’s popular with all types of investors, from first timers through to experienced developers.

With this technique, investors purchase properties that have large potential for long-term capital growth. You then hold onto the property for several years, eventually selling it for a profit.

Australia’s house prices have grown at an average rate of 7% approx % per year for the past two decades. That means investments purchased under this strategy can provide tens – or hundreds – of thousands worth of capital growth in just a few years’ time.

That provides excellent long-term returns. In the short-term, you can rent out the property to cover expenses such as mortgage repayments, improvements, maintenance and taxes.

Pay attention to rental yields when purchasing a property for Buy and Hold. If the rental yield in an area won’t cover your expenses, you will need sufficient income to pay for the shortfall yourself.

2. Positive Gearing

Positive Gearing (also called a positive cash flow strategy) refers to property investments that deliver enough short-term income to generate a profit.

Purchasing positive cashflow properties is popular with new investors. The money you generate acts as an additional income stream, and it can help you pay down your mortgage faster.

This additional income can potentially increase your borrowing power, making it easier to expand your portfolio further.

The trade off is that cash flow properties typically offer lower capital growth rates of 4% to 6%, but higher rental yields of of 6% plus

With lower initial prices and reduced risks, the Positive Gearing strategy is great for beginner investors, though managing your tenants involves hands-on work.

You should keep in mind that extra cash flow will require you to pay tax bills more frequently. If you wish to avoid Negative Gearing, you must ensure the rent you charge will cover all of your required payments (including your mortgage, interest, fees, maintenance and taxes).

Sometimes, you can achieve positive income and capital growth by investing in a location that you predict will gain demand in the long term. This is an advanced investment strategy, and these types of properties are highly competitive.

If you can secure this type of real estate, you can enjoy rental cash flow to pay off your mortgage as well as long-term capital gains.

Property Investment Masterclass

We will show you, the system we’ve developed with…

20 years+ experience in property investing and

6,500+ clients coached in 2 countries…

Build a multi million dollar portfolio in under 10 years

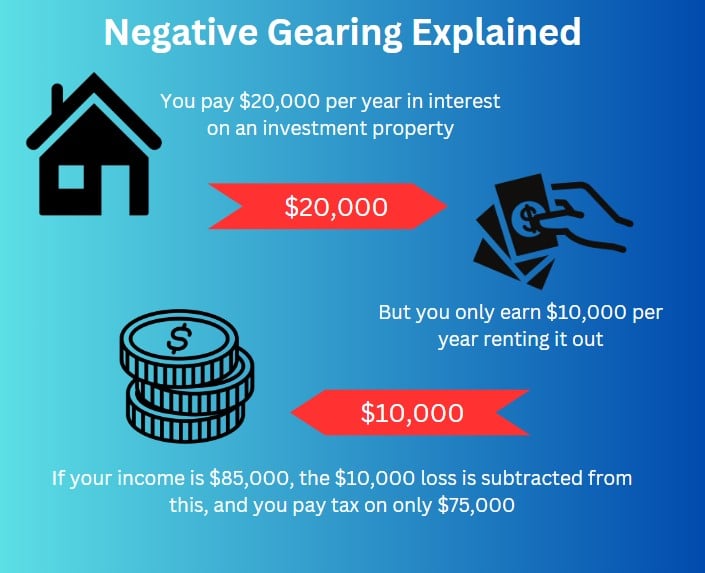

3. Negative Gearing

Negative Gearing refers to a property investment strategy where the short-term costs of the property outweigh the rental income it generates. In essence, you make a month-to-month loss on your investment, and you use your regular income to cover the shortfall.

That might sound like a bad deal, but there’s a catch – investors can claim negative gearing shortfalls as a tax deduction to offset your total tax liability.

In most cases, the strategy involves purchasing properties with high potential for capital growth) but low cash flow potential. You cover the short-term loss, eventually turning a large profit.

In the meantime, you claim a tax deduction for your losses, which offsets the amount of money you spent maintaining the property.

The downside to this strategy is that you need sufficient income to cover the short-term losses. This strategy is also better suited to investors in higher income tax brackets who have larger tax liabilities to offset.

Out of all investment strategies, relying on tax benefits is a high risk choice. We strongly recommend talking to an accountant and following their advice regarding Negative Gearing and whether it’s suitable for your situation.

4. Renovate and Hold

Renovations can be an excellent way to increase the value of your investment and build your equity. However, renovating a property is hard work, and it takes an experienced hand to keep the project on track.

With the Renovate and Hold strategy, investors purchase properties that have room for improvement. The property can then be renovated to increase its value.

Once the work is complete, you can rent the property out at a higher rate, which can potentially allow you to Positively Gear your investment.

Renovate and Hold can be incredibly effective for experienced investors. But it comes with more risk than purchasing a new property (or an existing property that’s in good condition).

As with any renovation project, it can be difficult to estimate an accurate timeframe and budget, making this a difficult strategy to execute.

On the flip side, choosing to renovate a property can allow you to enter popular suburbs at a low price point.

If you know what you’re doing, you could find yourself with a high capital growth, high rental yield investment, purchased for a fraction of the cost of a newer property.

5. Renovate and Sell

Renovating an investment can add significantly to its appeal to renters. That allows you to charge higher rents and Positively Gear the property. But, if a long-term investment strategy doesn’t suit your goals, Renovate and Sell can generate short-term profits.

Renovate and Sell involves purchasing properties that need improvement, making renovations, and then selling them for a profit a short time later.

This investment strategy has the potential for great returns, and equal potential for high risks. The costs associated with renovation projects are difficult to estimate.

Hidden surprises, unexpected labour, price fluctuations and timeframe blowouts can all eat into your profit. Additionally, this style of investing requires significant hands-on work by you, as it is your responsibility to oversee each part of the work.

On the other hand, an experienced renovator could turn a substantial profit with just a few improvements. The trick is knowing how to spot a property that can be flipped.

This requires significant understanding of construction, renovation, investing and local property markets, and is a strategy better suited to experienced investors.

Build a Property Portfolio with $100k or less

6. Building For Profit

Many investors are opting to build for profit and take on a house and land package and a small simple project

This style of investing simplifies the process of purchasing a property.

You get a brand new home that will appeal to renters (meaning that it may be suitable for Positive Gearing), and there’s less concern over short-term expenses such as renovations and maintenance.

Building a home can be a simple undertaking but the concept does require some design context.

The perfect home should marry to the land effortlessly and as a project, often the maths should work in your favour. $350,000 for the land and $350,000 for the home should actually equal $750,000. There is a way to make a profit by adding value to the land by building.

7. Property Subdivision

Property Subdivision involves finding a large block of land and dividing it into multiple, smaller parcels. Each parcel can be sold individually, which results in instant increase in equity.

For example, if you purchase a large block of land for $700,000 and subdivide it into two properties each worth $450,000, you have increased your equity by $200,000.

This strategy is best left to experienced investors that understand the ins and outs of development. Subdividing a property involves dealing with the local council and meeting strict planning requirements.

It also attracts additional planning, council and survey expenses, so you need to be confident that your initial outlay will return a profit.

It can also be difficult to find suitable properties for subdivision. Large properties are highly sought after, especially in desirable inner-city areas, which can eat into your profits.

Handy Info

2023 Residential Property Market Trends

Since the property market is fairly predictable, investors can foresee what trends will arrive shortly based on past patterns. You can use these predictions to your advantage when generating your strategy.

- Continual surge in home buyer demands: Australian house values will continue to rise, creating panic-purchasing behaviours that only elevate the demand.

- Property investors’ demands may trump those of home buyers: Real estate investors and homebuyers often battle over houses, with one side typically reigning supreme.

- A steady increase in property prices: Australian house prices will increase due to improved buyer confidence post-pandemic, reduced interest rates, high demand, and continued economic growth.

- Buyers might pay above market value for location: Location is everything when investing in a house, whether you wish to sell it or make it your home. Paying above the market value for a home in a highly desirable location is nothing new, and this won’t end anytime soon.

- The suburbs may see lower capital growth: In the past, all Australian estate investments gained value at somewhat equivocal rates, but recently, this growth split in two. You can expect to see a larger value increase in capital cities and inner-city suburbs than in outer-suburban divisions. Purchasing from a gentrifying area can offer much larger profits, though you will have to fork out more money up front.

What Different Types of Investment Properties Should You Consider?

An investment property does not need to be a residential house. You can invest in many different types of properties depending on how much you want to pay up front, when you want to earn money, how much you desire to own, and how much work you’re willing to give.

An investment property is not always a residential house. There are many different property investment options that may be suitable for you depending on how much capital you’re willing to invest.

Some common investment property options include:

- Standalone houses: Residential standalone houses attract high demand and can yield strong returns.

- Apartments and condos: Purchasing an apartment can allow you to target renters, offering long-term cash flow.

- Townhouses: Townhouses offer more indoor/outdoor space than apartments, making them a popular option amongst renters.

- Villas: Villas are larger estates in rural areas with high-purchase prices and potentially large payouts if you can find the right location.

- Entire apartment buildings: Apartment complexes are difficult to come by since full companies join the bidding war, though these complexes can be a great investment option if you’re willing to front the higher price tag.

- Student housing apartment buildings: Many recommend against this option since the profit margin is substantially lower.

- Industrial or commercial real estate: Commercial property investments can be an excellent strategy, though not a great starting place for new investors since it requires ample market experience.

Aside from selecting which type of property you wish to invest in, you will also need to consider if you want something brand new or a second hand investment property and how much you want to spend.

Next, we will discuss the pros and cons of apartments and houses, new and old properties, and low versus high prices to help you determine the right property for your personal objectives.

Learn How to Turn $100k Into an Investment Portfolio with

Positive Real Estate!

Spending your hard-earned money on investment properties can be tricky and stressful. There’s lots to learn, and managing your risk can be a challenge.

If you don’t know where to start then we always recommend seeking professional advice. The seminars and coaching sessions offered by Positive Real Estate can equip you with the real-world skills you need to succeed!

You can contact us online to find out more, or book a property investment seminar to get started with Positive Real Estate!

Apartments vs. Houses

Investing in an apartment offers lower purchase prices with potential for high returns as renters usually pay higher rent for the location and amenities. Fully developed apartment complexes typically enjoy steady value growth, though you may struggle to find prospective tenants in less-developed areas.

When buying older units, it’s important to note that renovating the unit to improve value can create challenges since the building owners and Body Corporates may restrict certain changes.

Property, more so houses with large land sizes, have consistently reported steady price appreciation and in turn are deemed a solid long term investment.

Whilst it can be more expensive to purchase a standalone house than an apartment, houses are more inclined to appreciate consistently over the property investment period as they are highly sought after for families and particularly, renters with children and pets.

New vs. Old

Purchasing a new property allows you to sell or rent with minimal time-consuming renovations. Many buyers and renters prefer new builds, so finding someone interested shouldn’t be hard.

The biggest issue with modern properties is how high the initial purchase price can be. In saying that, there are several tax benefits offered to new property buyers that second hand investment properties may not receive.

Opting for older real estate investments over new properties allows you to purchase at a much lower price and renovate to make instant positive cash flow.

The established property strategy requires a lot of manual time and effort, so you must factor in maintenance costs and estimated time for the property development process.

Low vs. High Price

High-priced properties require a much larger deposit sum and loan uptake, however investing in higher price brackets can generate great rewards.

Whilst during an economic downturn these property types can be harder to sell or rent as people are afraid of over-spending, they can also create the greatest capital growth % in times of an upmarket swing.

Cheaper properties will always stay in demand, even when the economy is bad, since people will want the lower price options.

Depending on your financial situation, the down payment and mortgage repayments may be far more accessible. With lower land tax costs and reduced risks, lower priced properties are highly competitive and harder to come by.

Building your property investment portfolio involves more than just picking the property type, price, and age. You must also determine how you plan to make money off of that property. Many sound property investment strategies exist that offer different ways to earn profits.

Dealing With Rental Property Managers

If you decide to go with the cash flow rental strategy, you must consider how you will deal with the property management.

Even with 12-month-lease tenants, you must cover the application and screening process, property maintenance and repairs and sometimes, cleaning or maintenance between residents.

Each time one of your renters complains about a broken AC, leaky faucet, or burned-out light bulb, you must resolve the problem quickly. When owning multiple properties, managing each can become very time consuming to do independently.

Typically, an established investor will hire one or more Property Managers to oversee all leasing information and maintenance duties. A Property Manager can help you collect rent, manage tenants and tradespeople when maintenance is required.

The extra work involved with the rental investment property tactic requires that you budget accordingly. You will need to pay any Property Managers, professional cleaners, maintenance teams, property insurance, increased utility bills, land taxes, and all maintenance costs, including expensive appliance replacements.

PROS

- Positive property market history: Australia’s investment properties feature a track record of consistent and profitable results. Over the last few decades, you can see a strong upturn in the property market.

- Decent outcome control: Rather than placing your bets on another corporation’s decisions, you can take total control of your investment. You cannot prevent a company from failing, but you can avoid making your own poor decisions.

- Convenient lending: Banks or private lenders feel more inclined to offer you a loan on an investment property rather than market shares. Lenders understand that you can always sell the property to pay off a loan, but you’re out of luck if your stock fails.

- Tax protection: In some instances, you can take advantage of different tax offers and programs like negative gearing.

- Secure appreciation: Properties do not randomly fail like businesses do, which means you can depend on consistent value appreciation.

- Insurance: When it comes to the risks involved with renters, renovations, or property development, you can easily purchase insurance packages to protect your investment.

- Short and long-term income: Depending on the strategy for your investment property, you can enjoy both short-term profits from renters and long-term wealth when you sell the property.

CONS

- Huge upfront investment: While you can pick your budget, investing in property generally requires a much higher upfront investment than typical stock shares do. Many buyers spend a minimum of $10,000 just on the deposit. As competition increases, so does the need for a large savings account or loan.

- Higher risks with fewer properties: Typically, beginner investors will start with just one property rather than buying multiple upfront. Placing all of your bets on one investment can be risky if you fail. While the property market is fairly low-risk, certain types of properties fluctuate in value more often than others.

- Unexpected expenses: When you own property, you must accept that surprise expenses will pop up at some point. You may need to pay for repairs, new interest rates, renovations, storm damage, and more. A simple hail storm may cost you thousands of dollars in roof repairs.

- Ongoing costs: Purchasing property is not a one-and-done deal. After the initial acquisition, you must continue paying for insurance, taxes, mortgage, renovations, property staff, utilities and more.

- Renter issues: When renting property, you must often deal with vacancies, missed payments, or other scenarios that prevent you from making the money you expected.

- Market and interest fluctuations: As supply and demand shift, the property market will also fluctuate. While house values generally increase, you may see dips in specific areas. Sticking to investment-grade properties can ensure that you don’t risk purchasing a depreciating asset.

- Unsuccessful properties: Non-investment-grade properties in a less-than-ideal location may create more expenses and problems than profits.

- Inaccessible funds: You cannot instantly sell your property for quick cash if life hits you with a curveball. Selling a house takes much more time and effort than selling stock shares.

- Potential government actions: While government laws are not a huge risk, you should keep in mind that certain rules, like negative gearing, might change in the future, so you should not base your strategy around such programs.

How Can You Reduce Property Investment Risks?

Investing in property includes some negative risks, though you can avoid many of these with adequate planning, knowledge and research. Here are some tactics to reduce your investment risks:

- Don’t spend everything—keep enough funds in your savings account for a rainy day.

- Find a relevant credit provider for your needs.

- Hire a mortgage broker to find the best loan rates.

- Opt to purchase your property in money-making, investment-grade locations.

- Consider new properties rather than renovations for fewer complications.

- Invest in income protection and property insurance.

- Purchase multiple properties in case one fails to provide a steady income.

- Hire a professional Property Manager to oversee rentals and a contractor for renovations.

- Plan any future investments within your budget.

- Speak with a tax professional before making any purchases.

- Plan and track your tax deductions ahead of time.

- Track your investment performance and re-assess based on success.

- Do not feel afraid to sell if the investment falls short of expectations.

- Do not quit your main job until you save up enough money from purchasing properties.

How to Create Your Property Portfolio Strategy?

Now that you know the different property types, tactics, benefits and risks, it’s time to begin your investment journey. The first step is to plan out your strategy.

Investment strategies require thorough research and details, but you can ensure that you cover all bases by following the steps below.

- Create your business profile: Investing is a business, and you should treat it that way. Set up an additional bank account and a correct email address.

- Decide on property type: Decide which property you want to purchase first. Consider residential houses, apartments, condos, commercial properties, new builds, renovation projects, or entire apartment complexes.

- Build your investment strategy: Depending on your property type, you can decide whether you will choose a cash-flow renter income or a capital growth strategy.

- Target a location: Selecting an optimal location is very important, so you should conduct ample market research before deciding. Consider which areas can expect the largest price increases in the near future.

- Consider tax benefits: Before making any purchases, plan your tax strategy and allocate a certain amount of your budget toward these payments.

- Create a budget: Now, consider your funds, property type, location, and expected taxes to generate a realistic and safe budget that leaves room for surprises. Be sure to also think about your down payment.

- Find loans or finance options: If you cannot fund the project yourself, present your budget and investment plan to a lender to receive a loan for the property.

- Purchase and renovate: After receiving adequate funds or pre-approval, you can shop around, bid on your favourite property, and purchase. If the house needs renovations, hire a contract team to help you manage the process.

- Rent or sell: Once you’ve finalised any property changes, you can sell or rent it out to tenants.

- Use profits for your next investment: The investment cycle is ongoing. The more properties you purchase, the more funds you can make for future investments.