How To Prepare for a Rise in Interest Rates

Right now, in Australia, we are experiencing a record low in interest rates – meaning cash is cheap and it’s a great time to borrow and invest.

But it’s unlikely to last. In fact, it’s not a matter of if more than it is when…

Smart property investors know that it’s dangerous to get too comfortable. Real estate is an ever-changing thing. Markets go up, down and plateau – and so do interest rates.

The question is, how prepared are you for a sudden spike?

PLAN AHEAD NOW

The key to being ready is having a strategy.

Before you spend a single cent on property, you should first devise a long-term plan that takes into account:

- Changing interest-rates

- Changes in capital growth

- Emergencies

- Changes in personal circumstance

Let’s be clear.

While a clever strategy considers and plans for all of the above, the end-game itself is NEVER influenced by any of these changing factors. Instead, because these variables are anticipated and accounted for, investors can remain focused and unphased by market distractions or disturbances.

DOUBLE DOWN ON OPPORTUNITY

If you’ve invested or held property in Australia in the past 12 months you’ve probably locked in some low-interest rates.

Hopefully your rent rates are healthy and you’re in a positive cash flow situation, with more money coming in from your investment than is going out.

What you do with that cash flow will make all the difference if interest-rates rise.

Spend it on assets that look pretty but don’t appreciate – think cars, jet skis, expensive clothes etc – and you’re not taking advantage of a good situation.

WHEN THE GOING GETS TOUGH, THE BUFFER GETS GOING

Instead of splashing out on high-ticket items because of the savings you’re making off low-interest rates, use this opportunity to get ahead of the game.

The number one thing property investors need to do when the going is good, is to create a financial buffer for each of their investment properties.

A buffer is an emergency amount of capital or money that investors can use. The key to this buffer is that it’s liquid. It’s real cash that you can get your hands on easily and quickly.

A buffer protects you if your circumstances change, if a tenant doesn’t pay rent, or if something in the property breaks and needs a fast replacement.

It also means that when interest rates increase and your rent rates take a while to catch up, you stay in the black.

Over time, if you continue to pay into the kitty, this buffer can even allow you to renovate your property when it needs a lift, which will help to keep your rent rates high.

We recommend having anywhere from $5-10k per property to make sure you never have to put your hand in your own pocket for when the unexpected happens.

As property investors we want 100% of the cost of our properties – that’s renos, insurance, emergency maintenance and any interest-rates spike – to come out of a buffer, and not our pockets.

Talk to the coaches at Positive Real Estate about how to structure your strategy so that your buffers are healthy enough to keep your properties paying for themselves.

DEVELOPING YOUR INVESTOR STRATEGY

There’s no denying that everyone has an opinion regarding the real estate market right now, but the truth is, no-one is an expert except the experts! They’ve been in the game long enough to see how the different property cycles work and what you need to be aware of right throughout your investment journey.

Learn more about how you can take advantage of the current property market at one of our free property investor seminars. You’ll be led by a team of professionals who have demonstrated experience working across all types of markets so you can optimise your ability to grow a budding portfolio, create passive income and get set for the future – whatever that may look like for you.

Spaces are limited.

Recent Articles

10 Property Investment Tax Mistakes To Avoid

Tax isn’t often one of those conversations that give investors the warm fuzzies, especially when we’re talking about the 10 property investment tax mistakes to avoid! But it’s important that property investors reframe their thoughts around tax. Owning real estate can actually be incredibly tax effective – in fact some might say tax is a secret weapon for property investing.

How Lenders Assess Valuation Risk Factors When Financing

Ever thought you’d picked an absolute winner of a property only for the bank to come back with a list of valuation risk factors? It’s more common than you think, particularly in a rising market where values fluctuate so much that our ideas of what a property is worth actually start to disconnect from what a valuer sees.

Tips For Buying An Investment Property

Have you decided to take the property investment journey but are feeling clueless as to how to actually board the train? We’re going to give you our top five tips for buying an investment property in 2022 to help point you in the right direction!

Is Property Investment a Good Investment Asset for You?

Why is property investment a good investment? Why not invest in shares or bonds instead? Which investment is the most secure? If you’ve come to a crossroads in your life where you’re ready to start building your wealth but questions like these are bouncing around your head, then it’s time to sit down and start your education on investing.

Buying an Investment Property Before a First Home in Australia?

Owning property has always been part of the great Australian dream. A lot of people want a place to call their own, with stone benchtops, the latest appliances and a great entertaining deck out back. So, when interest rates hit a record low in the last couple of years and it suddenly started to cost the same to own as it does to rent, why wouldn’t you have just bit the bullet and bought your own home?

The Ins and Outs of Real Estate Risk Management

If you’re new to property investing, what is your risk profile and how do you plan to handle it? Real estate risk management is essential to quashing those all-encompassing fears that can follow investing…

Positive Cash Flow Property – Ultimate Guide 2023

If you want to become a superstar property investor and be on the path to financial freedom, then you’re going to need this guide to investing in positive cash flow properties! Investors that follow a positive cash flow strategy understand that living off passive income is the key to an early retirement – and the only way to do that is to make our money work for us, not against us.

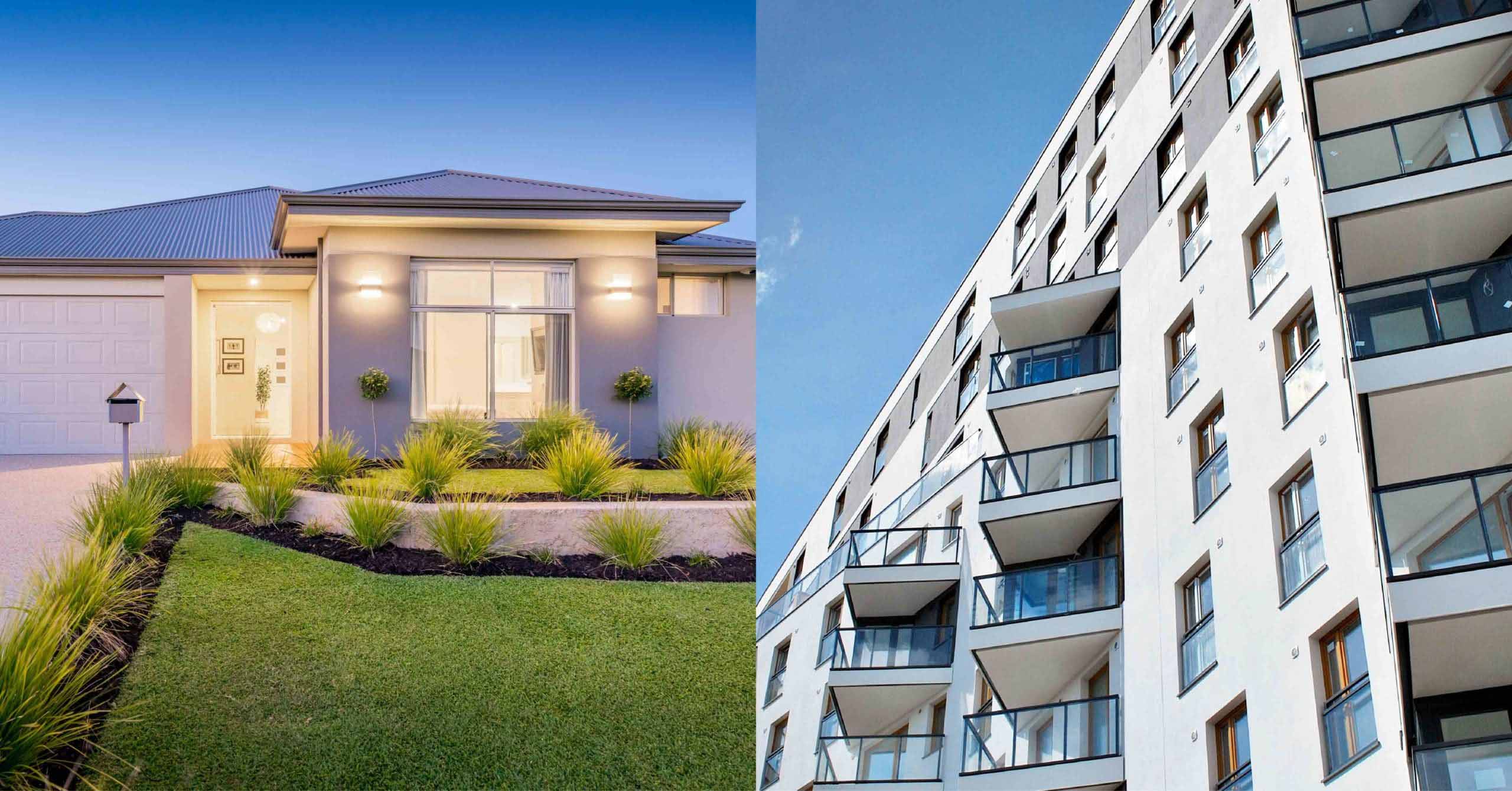

House Vs Apartment Investment – Which Is Better?

These days property comes in all shapes and sizes, giving property investors more options than ever before. The question on everyone’s lips when it comes to the house vs apartment investment equation, is how do you truly know which is better?

The All Monies Mortgage Clause – What You Need To Know!

This article is about the all monies mortgage clause and how it can potentially affect your property investment. When you signed your bank loan agreement to secure funds for a mortgage, did your contract contain an all monies mortgage clause?